Perhaps the site of a new abode

A little more than a week ago, we saw an interesting piece of land not too far from where we live - just on the other side of the station, in fact. It's nestled into the corner of an alley in a charmingly run-down historic neighborhood. The lot is about 100 square meters in size, with an 80-year-old house atop it. It may soon be ours, because now we are in the throes of getting a mortgage and a home loan.

When you are buying property in Tokyo, there are a million things to know. Here are a few I've learned along the way:

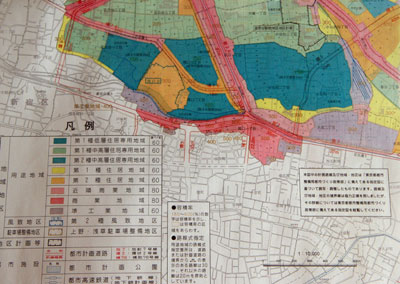

- Roads legally must be 4 meters wide, but many of Tokyo's streets are narrower. If you buy land on a street narrower than 4 meters, you effectively donate the difference to make up your half of the 2 meters. This is called setback.

- You may only build on a certain percentage of your land. Generally this is 80% or 60% and the amount is determined by the zoning category. This rule is called kenpei ritsu.

- Another building restriction is the maximum square footage your building can be. This is determined by the width of your road and the zoning. On a wide street in a commercial district, you might be able to build 600% of the land's area. In a residential area, it's likely to be 150% - 300% depending on the road but basement rooms are excluded from the square footage total. This rule is called youseki ritsu.

- Zoning rules also include a maximum height for your building - narrow lots and residential areas have lower maximums. If your building is taller than ten meters, you must follow additional guidelines about sunlight and shadows falling on neighboring buildings.

- Some neighborhoods, where wooden building are tightly packed, require special construction precautions for fire (called bouka chiiki). According to the current laws, all buildings must be built 50 cm away from the edges of the lot. Eventually, if everyone follows this rule (and I've seen many cases where they did not), there will be at least a 1 meter gap between all buildings in the city.

- Not all property has ownership rights - some plots in Tokyo are still on an old leasing system. These places are dwindling, but there are still a few on the market. They always look like a good bargain...

Bunkyo-ku zoning map

Gaijin-friendly Lenders

After you wade through the rules and find a property that suits your needs then, unless you are very rich or have been saving for decades, you have to get a loan.

Obtaining a mortgage in Japan is not the easiest prospect if you are a foreigner with neither permanent residency nor a Japanese spouse. If you don't meet those conditions, many banks won't even say hello. Rightly so, as there is a risk that your future visa renewals will go sour and you won't be in Japan to repay your debt. Fortunately for those of us with a desire to settle down in Japan, it's not a completely impossible prospect. There are a few institutions that will loan to non-PR foreigners.

I don't want to jinx our chances (and this purchase is hardly a done deal - we are still negotiating with the property owner) but I do want to share what I've learned about the process so far, just in case you were thinking of buying property in Tokyo. Or if I ever need to go through this again...

For a land purchase where you plan to build your own home (as in our case) you need to take out two separate loans. I don't think it's done that way in the US, but this is normal in Japan as it saves you the cost of repaying the construction loan until the building phase gets underway. But it means two loan applications and I assume two sets of loan fees, stamp tariffs and other closing costs, which are considerable.

- Shinsei Bank.

- Shinsei is known to be foreigner-friendly and they have English-speaking customer service so that puts them in my good graces. Loans to non-PR foreigners are possible, but there is scads of paperwork. After you turn in your last two years' income and tax statements, the contract for land purchase, foreign registration cards, and the application forms, the bank perform an appraisal on the land before granting the mortgage. They will knock down the loan amount or refuse outright if they find fault with the property.

- They also do a "pre-appraisal" on the planned house before the land loan is granted. This is unusual, according to our architect, who is scrambling to get us preliminary plans and a budget for the bank. For non-PR foreigners, Shinsei require a second mortgage on the property until you become a permanent resident, and you must beg a favor from a Japanese friend to accept mail for you in the event you leave Japan (and the friend has to attend the closing to make it an official favor).

- Mitsubishi UFJ.

- Acting on a clue from Danny Choo's account of purchasing property in Tokyo, I filled in a form on the UFJ website and received a huge application packet in the mail. The forms and instructions are entirely in Japanese - fine-print legal Japanese. Ouch. I will see how things go with Shinsei before I delve in there too deeply. I think there will be lots more paperwork than just this inch-thick application.

- Suruga Bank.

- They lend to anyone through their "Gaikokujin Home Loan" program. It's very nearly "no questions asked" though they require the transaction to be conducted in Japanese. However, for Suruga's minimal paperwork you pay maximal interest. Their current rate is about 4.5%, or 2 percent more than typical Japanese banks.

- New City Mortgage.

- I have not thoroughly investigated this option, but they do loan to foreigners without PR status. Interest rates are not he most favorable from what I've been told.

Let's hope all this explanation hasn't ruined our application karma, that the owner will accept our offer, that the bank will approve our loan, and that all of this will be quickly concluded so that we can move on to the fun part - designing the house.

Recent Comments